If you are a recruiter who offers contract staffing services to your clients, you need to know whether contract employees get paid overtime or not. Overtime wage lawsuits take place left and right because of improper employee classification and misunderstanding the law. So, do contract employees get paid overtime?

What is a contract employee?

First, let’s clarify what we mean by contractors. We are not talking about 1099 independent contractors. We are talking about workers who are placed on a contract basis at a client company. They are W-2 employees using employer of record services from a third party.

Sometimes, employers need a temporary employee they know can handle the job. That’s where recruiters come in. Recruitment agencies send contract employees to businesses in need. Contract employees are still considered employees. The contract employee is on the payroll of the recruitment agency or a separate W-2 employer of record, not the client’s payroll.

What is overtime pay?

The Fair Labor Standards Act established rules on overtime pay to make sure employees are fairly compensated for additional work. According to the FLSA overtime rules, nonexempt employees who work over 40 hours in a workweek must be paid at a rate of 1.5 times their regular pay for each additional hour.

Some states have more stringent requirements. For instance, workers in California must be paid overtime for any hours worked over eight in a day.

Exempt employees

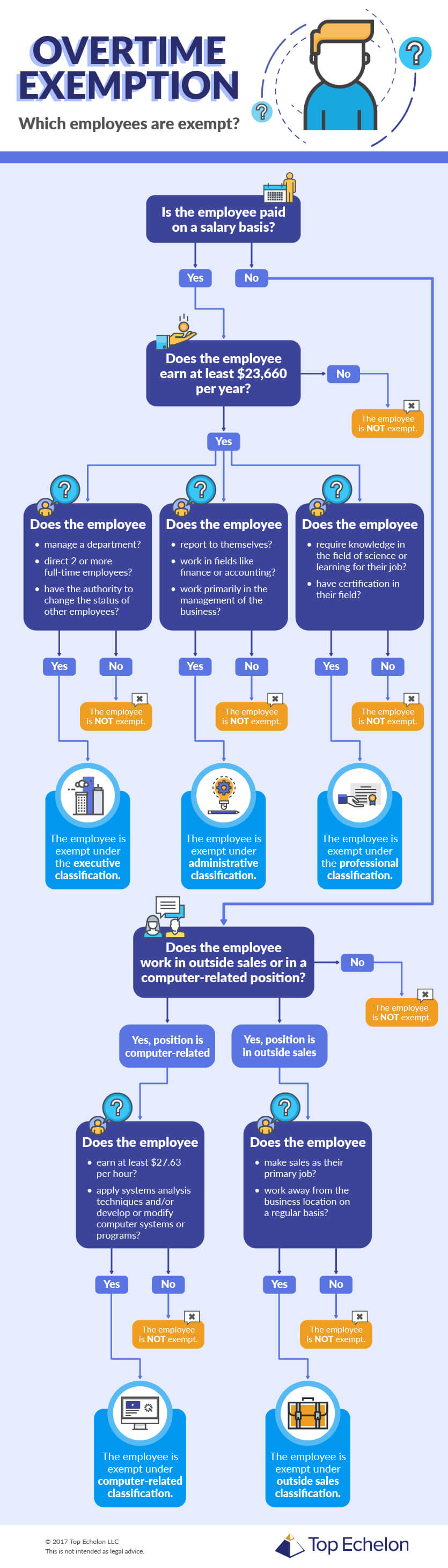

The FLSA allows certain employees to be classified as exempt from overtime. To be considered exempt from overtime pay, the employee must be paid on a salary basis, make at least $23,660 per year ($455 per week), and have job duties that are considered exempt. Exempt employees’ job duties must fall into one of the following classifications:

- Executive

- Administrative

- Professional

Keep in mind, however, that you can’t give an employee a job title just to make them exempt. For example, calling someone an executive does not automatically make them exempt. They must meet certain requirements provided on the U.S. Department of Labor website.

Executive

A contract employee must meet the following requirements to be classified under executive exemption:

- Manage the business or a recognized department of the business

- Direct two or more full-time employees

- Have the authority to hire, fire, advance, promote, or change the status of other employees

Administrative

For a contract employee to be considered an administrative employee, their primary duty must be directly related to the management of the business or general operations. And, they do not need to report to a supervisor.

Specific areas the Department of Labor (DOL) places under this category are:

- Finance

- Accounting

- Marketing

- Safety and health

- Human resources

- Public relations

- Government relations

- Computer network

Professional

To fall under the learned professional employee exemption, the contract employee must meet the following criteria:

- Primary duty must require advanced knowledge in the field of science or learning (e.g., medicine, law, etc.)

- Must be certified in their field

Employees can also fall under the creative professional exemption category. Their work must require invention, imagination, originality, or talent in an artistic or creative field to qualify.

What about contract employees working in computer-related occupations?

There is one important exception to the salary rule that may apply to some of your contract employees: professionals working in “computer-related” occupations who earn at least $27.63 per hour or $455 per week can still be paid on an hourly basis and remain exempt from overtime.

Simply working with a computer does not exempt someone from overtime pay. According to the FLSA, they must be employed as a computer systems analyst, computer programmer, software engineer, or other similarly skilled position. And, the employee’s main duty must match one or a combination of the following requirements:

- Apply systems analysis techniques and procedures

- Design, develop, document, analyze, create, test, or modify computer systems or programs related to user or system design specifications or machine operating systems

This exemption does not cover people who work on the manufacturing or repair of computer hardware or other equipment. It also does not include people who depend on computers to do their jobs, such as engineers and drafters.

What about outside sales occupations?

Salary requirements do not apply to those under the outside sales exemption. In order to be exempt from overtime laws, the employee’s job must be making sales. And, the employee must work away from the business location regularly.

Do contract workers get paid overtime?

Again, contract employees are not to be confused with independent contractors. Independent contractors are workers a business hires to complete a job. These workers use their own tools, decide how to do the project, and can work for multiple different companies at once.

So, do contractors get paid overtime? Contract employees receive overtime because they are on the payroll of the W-2 employer of record. But, independent contractors are not included on the business’s payroll. Independent contractors, separate from contract employees, do not get paid overtime. Independent contractors are not on the business’s payroll or the payroll of a separate W-2 employer of record.

As employees included on payroll, nonexempt contract employees receive overtime. Be sure to correctly classify employees to comply with DOL laws. They must receive the contractor overtime rate of 1.5 per hour worked past 40 in a workweek.

Let’s say you place a nonexempt contract employee with your client. That employee is paid hourly at $14 and works 45 hours in one week. You would need to pay the employee $560 for the normal hours worked ($14 X 40), plus $105 in overtime wages [($14 X 1.5) X 5]. To pay your employee’s wages, bill your client.

Client conflicts

Clients may try to push you into paying nonexempt contractors on a salary basis because they don’t want to pay extra for contractor overtime, but this is one area where you cannot give in to make the client happy.

Incorrectly classifying the contract employee can put both you and your client at risk. The DOL can hold you and your client liable for violations. When in doubt, review the DOL’s regulations and seek legal advice.

What to do if a client doesn’t want to pay contractors overtime

If your client doesn’t want to pay overtime, you can put a restriction in the employee’s contract that says overtime is not to be worked. Keep in mind that if the contractor works more than 40 hours in a work week, you would still be required to pay the overtime, but you may not bill the client for it.

If you feel like your profit margin is high enough, another way to handle the situation is to give your client a “discount” on the overtime bill rate by charging them less than 1.5 times the regular bill rate. Just remember that the discount comes off of your hourly income.

Sometimes, the best course of action is to simply educate the client on FLSA regulations. A good way to do that is to direct them to the Department of Labor’s resources regarding overtime pay. As a result, you protect yourself from legal risks and establish a reputation as a trusted employment expert to your clients.