The U.S. staffing industry often encounters two types of contingent worker arrangements: 1099 independent contractors and Corp-to-Corp (C2C) workers. While both are common for project-based or specialized work, they have distinct legal, financial, and compliance implications. Understanding these differences is essential for staffing agencies to mitigate risks, remain compliant, and provide the best value to clients and workers alike.

1099 Independent Contractors

A 1099 worker is a self-employed individual who operates independently and directly contracts their services to a business. These contractors are classified under the IRS Form 1099-NEC, which is used to report non-employee compensation.

Key Features of 1099 Workers:

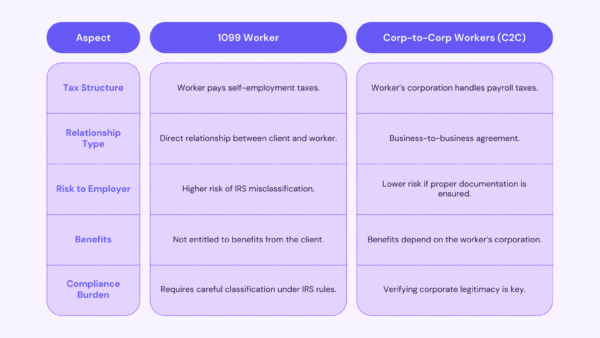

- Direct Relationship: The worker provides services to the client or staffing agency without a corporate entity.

- Self-Employed: They are responsible for their own taxes, including self-employment tax (covering Social Security and Medicare).

- No Benefits or Protections: Businesses do not provide benefits like health insurance, paid leave, or retirement contributions.

- Flexibility but High Compliance Risks: Employers must ensure that the worker meets strict IRS criteria for independent contractor status. Misclassification can lead to significant penalties.

Common Use Cases:

- Freelancers or gig workers.

- Specialized professionals offering short-term, high-skill services like IT consulting or design.

Corp-to-Corp (C2C) Workers

Corp-to-Corp arrangements involve a business-to-business (B2B) relationship where a worker operates through their own corporation (e.g., an LLC or S-Corp) or is employed by a third-party corporation. In this case, the staffing agency contracts with the worker’s business, not the worker directly.

Key Features of C2C Workers:

- Entity-to-Entity Relationship: The agreement is between two corporations, which shifts liability and compliance responsibilities.

- Tax Responsibility on the Corporation: The worker’s corporation handles payroll taxes, benefits, and other employer obligations.

- More Legal Protections for Businesses: Because the worker is technically employed by their own entity, the staffing agency has reduced risk of worker misclassification.

- Higher Administrative Complexity: Verifying the legitimacy of the worker’s corporation and ensuring compliance with applicable laws is critical.

Common Use Cases:

- IT contractors operating through their own LLC.

- Consultants employed by third-party staffing firms or Employer of Record (EOR) platforms.

Key Differences Between 1099 and C2C Workers

Compliance Risks for Staffing Agencies

1099 Risks

Misclassifying a worker as a 1099 independent contractor when they should be classified as an employee can result in penalties, back taxes, and lawsuits. Agencies must evaluate the level of control over the worker’s tasks, hours, and tools to determine proper classification. Agencies could also partner with an Employer of Record (EOR) to allow the EOR to take on the classification process and employment risks.

C2C Risks

While C2C reduces misclassification risks, it comes with its own challenges:

- Ensuring the worker’s corporation is legitimate and not a sole proprietorship incorrectly claiming corporate status.

- Contractual diligence to define the scope of services, liability, and termination clauses.

How to Manage These Worker Types

Staffing agencies can take the following steps to navigate 1099 and C2C arrangements effectively:

- Use an Employer of Record (EOR): Partnering with an EOR can offload payroll, compliance, and benefits administration for both 1099 and C2C workers.

- Implement Vetting Processes: Verify 1099 workers’ independence and C2C corporations’ legal and tax compliance.

- Educate Clients: Help clients understand the pros and cons of engaging 1099 vs. C2C workers, along with associated risks.

- Leverage Technology: Modern workforce management platforms can streamline compliance checks, payroll, and reporting.

Conclusion

Both 1099 and Corp-to-Corp worker arrangements play a vital role in the U.S. staffing industry, especially in sectors like IT, healthcare, and consulting. However, understanding their differences and managing compliance effectively is crucial to protecting your business and supporting clients. By staying proactive and leveraging the right tools and partnerships, staffing agencies can navigate these complexities and focus on delivering exceptional service.

Need help managing your contingent workforce?

FoxHire’s Employer of Record platform simplifies the complexities of compliance, payroll, and worker classification. Reach out today to see how we can support your staffing agency.